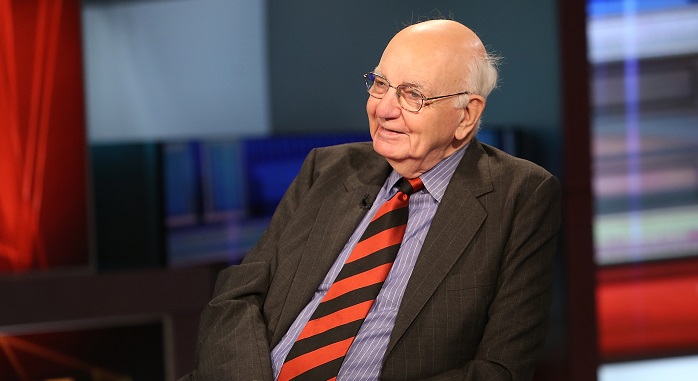

Risk goes deep on Volcker rule

Risk has published the second part of its series on the history of the Volcker rule. The writer, Peter Madigan, has a great track record of long-format reporting on the sausage-making that is financial regulatory reform, and this story is no exception. It is worth your time.

The only concern I have about stories like this has less to do with the reporting effort and more to do with the motives of the sources telling the story. Due to the revolving door between Washington and Wall Street, a staffer who worked for weeks or months helping craft Dodd-Frank might now work for a bank or lobbying firm that is looking to tear down piece Dodd-Frank. They now have financial incentives to characterize something that was their pride and joy years ago as something they created on a whim over a long lunch.

Madigan does well to mesh the varying accounts from different sources, but there are still some places where his sources tell conflicting versions of what happened. When you read the piece and confront these ‘he said-he said’ details, be sure to ask yourself which source now has a job that might motivate them to shift the narrative.

The BIS looks at CEO compensation

This paper from the Bank for International Settlements analyzes whether CEO compensation guidelines issued by the Financial Stability Board in the wake of the financial crisis are delivering the desired effect. It turns out that guidelines are actually working.

“We find that bankers’ pay regulation had a significant impact on the structure of CEO compensation of the banks under the scope of the application of the policy. … Our results are more pronounced for investment banks and for the banks without a CRO in place. This result … suggests that the policy has been most effective at banks where governance of risk management was weaker.”

The fact that the rules were most effective at banks with prior risk management deficiencies seems like a particularly big win for the FSB.

JPMorgan is eyeing Poland

Make no mistake. The fact that JPMorgan is exploring Warsaw as an option to for its new back office operations center has less to do with Brexit and more to do with talent. The talent is not only cheaper, but an executive at a blockchain firm once told me cities like Warsaw and Budapest are luring financial services firms large and small because the talent is as good – or better – than what is available in London or New York.

Net Neutrality madness

Some Americans want to ban Muslims from entering the country. Some Americans want to build a wall on the border with Mexico. And some Americans want to bomb ISIS into oblivion. But I am not sure there is a single American who sits down at the dinner table and says, “I wish my Comcast bill was higher.” Or, “My Netflix subscription is too cheap.” Or, “The one thing holding back innovation in America is fair access to the internet.”

And yet the corporate dollars that control the Federal Communications Commission look set to propose a new way of charging entities to access the internet. There are a lot of things in America that need fixing. Access to the internet isn’t one of them. If it ain’t broke, don’t fix it.

And for those groups getting set to fight the FCC, here is a bit of free advice: Ditch the term “Net Neutrality.” Many people don’t even know what that means.

WYWW Appetizers

- Capitol One and Discover reported potential red flag from the world of consumer finance.

- Energy Secretary Rick Perry delivered the keynote speech at the Bloomberg New Energy Finance Global Summit.

- Arsenal striker Alexis Sanchez embarrassed himself.